The Greater Manchester area is shaping up to be next the techno hub in Europe. It’s the ideal place for startups, and companies that want to grow organically from the roots up, and London based companies have seen the promise of the area and are either planting their own seed offices in Greater Manchester or uprooting their offices from the capital to the northern region. Pushing the digital transformation boundaries further are FinTech startups and companies already in operation in the region. FinTech is arguably the biggest disruption in the way we do business and live our lives. It’s been described as a disruptive way of using technology to drive economic value in ways we didn’t think possible.

Why Greater Manchester?

Manchester is a melting pot of talents, its universities have world class computer engineering and sciences programs, and 85,000 people have migrated to the northern region for better lives – opportunities as well as standard of living. People in the region have the “can-do mentality” and the Greater Manchester area has that real energy that has proven to synchronize with the tech and innovation vibe. For tech companies like Peak, the area has the right business conditions to succeed, the talents to help them from roots up, access to capital and travel connections. These are all in the area.

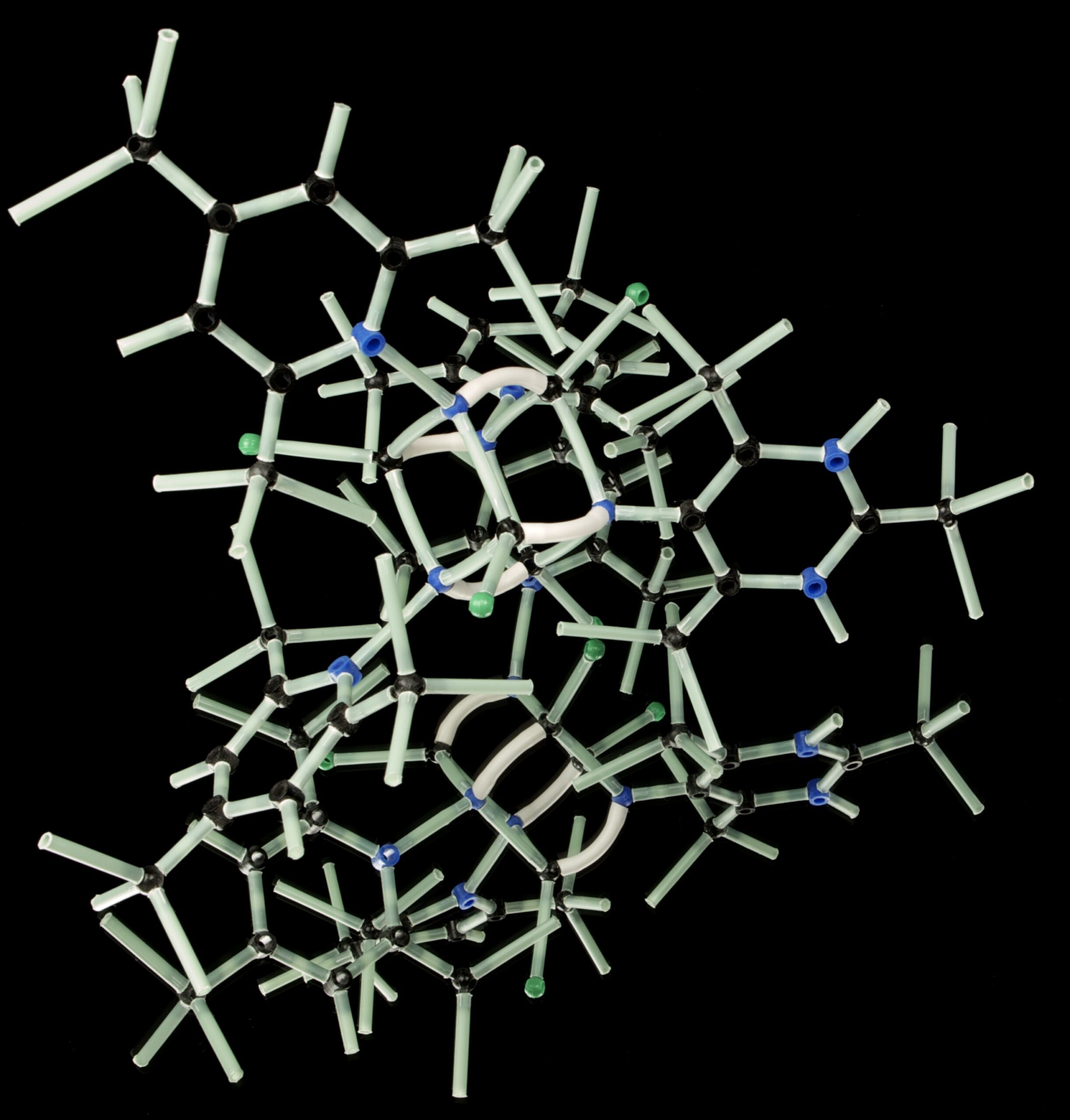

Another arsenal of the northern region is that it’s the location of the Graphene Institute, leading the world in knowledge-based graphene commercialization and technologies enabling manufacturers to come up with solid smart technologies and products that will revolutionize the way we live. This puts Manchester in the global playing field as more jobs and investments are made from graphene tech products.

How FinTech Comes Into the Region’s Playing Field?

Investment, capital and the shift in how business is being created, done and delivered is where FinTech comes in. Financial Technologies or FinTech by definition means the evolving intersection of financial services and technology. It’s now changing the way companies do business, technologies that disrupt sectors such as bill payments, money transfers, loans, fundraising and asset management. It’s the financial niche that flows with trends on how people are choosing to live their lives including how they make a living, work, and invest. It has the unadulterated essence of bringing to the masses what used to be only available to the elite – transparency and accessibility. The legacy of PayPal – an online system that uses electronic payments, an alternative to paper methods has now pivoted to other financial services that are faster, efficient, more transparent, accessible through multiple devices and cheaper. Technologies from startups are changing the game in giving financial services to people in everything from payments to fundraising which is now called crowdfunding and regional transfers.

In the forefront of this FinTech services are boutique banks such as GP Bullhound which opened their Manchester office in 2013. Crowdfunding platforms have followed suit with the opening of the Crowdcube office in the northern quarter of the city. AccessPay is another FinTech company that moved from London to Manchester with £2 million pounds of fresh funds. The company is expanding to the US and is looking to recruit 60 new talents.

As Greater Manchester is in the forefront of digital transformation in Europe, and becoming a global player in technologies and innovations; FinTech has taken root in the area to flow with the current trend in providing faster and cheaper services that big banks can only dream of at the moment. Hopefully the innovations started by these technologies are picked up by other sectors as well, such as healthcare and insurance. All the digital transformation from disruption brought about by technologies and innovations comes from the northern region of Greater Manchester.